If the idea of saving money by offering self-funded health benefits to your employees appeals to you but the RISK of paying out large, unexpected or unplanned claims concerns you . . . you will be happy to know this.

Stop-Loss insurance is a policy that works in conjunction with self-funded health plans. It is an insurance product that provides protection to employers from the financial risk of catastrophic or unpredictable high cost and/or high volume of claims filed under the plan. Stop-loss coverage protects against claims that could compromise the company’s financial health at any given time.

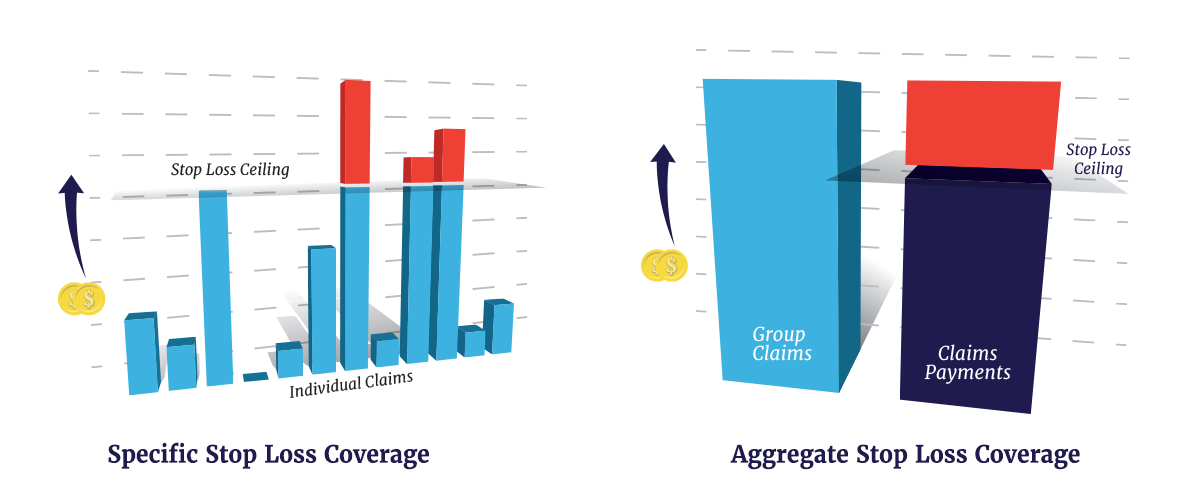

Types of Stop-Loss Insurance Coverage

Employers have two categories of coverage to consider.

Specific

Specific: protection for high claims on any one individual member.

Aggregate

Aggregate: protection that establishes a ceiling on the amount of total expenses during a contract period.

Stop Loss insurance is typically purchased by the employer through a TPA or directly from a carrier underwriter. Working with these experts, an employer can determine their threshold of claim payment risk and thereby set the desired level of protection needed.

Frequently Asked Questions

Q: How does Stop-Loss work?

A: A TPA can source a Stop-Loss insurance carrier who will assist an employer in setting risk limits and terms of a policy. TPA’s coordinate the policy’s premium payments to the carrier as well as provide administrative services in managing Stop-Loss claims as they occur.

Q: How beneficial are claim reports provided by a TPA?

A: Federal regulations require TPA’s to track and provide reports to clients. These

company-specific reports are updated regularly and contain actionable information that can identify cost savings, guide plan customization and wellness strategy of an employer.

Want to Learn More?

Additional SmartSheet topics are available on the Educational Resources page.